Washington – Donald Trump told The Associated Press this week “there’s nothing to learn” from all those income tax returns he won’t release until an ongoing audit wraps up.

Really?

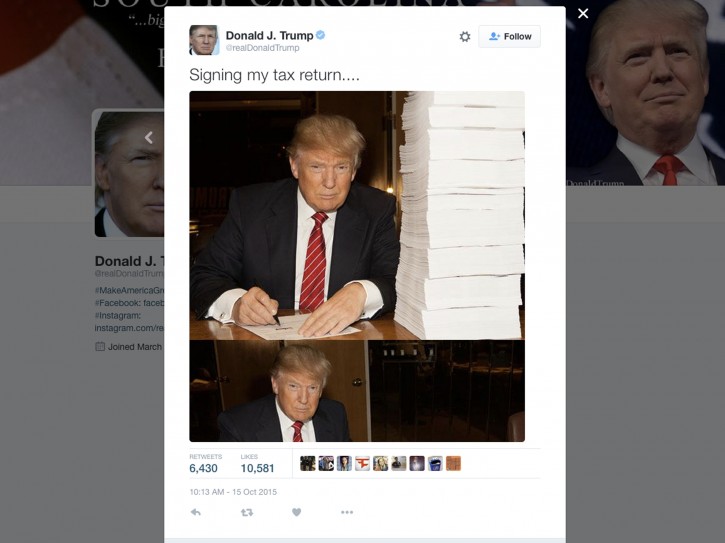

Tax experts say the feet-high stack of returns that he’s posed with for photos could provide significant insights about the presumptive GOP nominee — new details on his income and wealth, how much he gives to charity, the health of his businesses and, overall, how Trump plays the tax game.

Some information that may be embedded in Trump’s tax returns:

HOW RICH?

Trump’s tax returns wouldn’t give a full picture of his wealth, since people don’t have to report assets. But they would provide fresh clues about the financial life of the richest-ever presidential candidate, who’s admitted he’s prone to “truthful hyperbole.” Tax returns could help determine whether Trump has been overstating — or understating — his income. On a press release with his financial disclosure form released last year, for example, Trump put his 2014 income at $362 million, excluding certain items like interest and dividends. But that figure appeared to include revenue that wouldn’t count as taxable income. For example, Trump’s disclosure form included $4.3 million in “golf-related revenue” over 18 months from his course in Scotland. But the course lost more than $2 million in 2014 after its costs were taken into account. Depending on how it’s reported, a significantly smaller income figure on Trump’s Form 1040 than on his financial disclosure could be a fresh sign that his personal fortune, too, is less than the “more than $10 billion by any stretch of the imagination” that he’s claimed.

___

LOW-TAX, NO-TAX?

Trump, with trademark modesty, told the AP that “nobody knows more about taxes than I do — maybe in the history of the world.” And he’s been clear that he tries to pay “as little as possible.” Tax experts say he might even have owed no income taxes in one or more recent years by using real estate depreciation provisions and carrying forward business operating losses from previous years. Such losses can be carried forward up to 20 years on personal taxes. Author David Cay Johnston, in his book “Temples of Chance,” found that Trump reported negative income early on in his business career. According to documents unearthed by Johnston, Trump in 1977 made $118,530 and paid $42,386 in taxes; in 1978 reported negative income of $406,379 and paid nothing, and in 1979 reported negative income of $3.4 million and again paid no taxes. The Trump campaign did not immediately comment Wednesday on whether he has owed any taxes in recent years.

___

PLAYING THE GAME

People can play it safe with their taxes or take aggressive steps to limit their liability. Trump has said only a “really stupid person is paying a lot of taxes.” His overall approach to his tax returns will show “how he plays the game with taxes,” says to Joseph Thorndike, director of the Tax History Project at the nonprofit Tax Analysts. “It’s a big piece of someone’s financial life. It’s completely opaque to us at this point.”

___

BRAND TRUMP

A big chunk of Trump’s personal wealth is tied up in the value of the Trump brand name, which he licenses far and wide. The billionaire estimated his personal brand and marketing deals at $3.3 billion when he announced his candidacy last year, but Forbes magazine knocked that down to a much more modest estimate of $125 million. Trump’s tax returns could offer information about how much licensing income he receives, providing new clues about the true value of his brand, according to Thorndike. “It sheds light on the issue but it’s not going to be a slam-dunk answer,” he says.

___

TRUMP’S GIVING

Charitable donations — who people support and how much they give — can tell a lot about their values. Trump told the AP he does most of his philanthropic giving in his own name rather than through his foundation, but he didn’t detail to whom or how much he donates. Itemized charitable donations on his tax returns would sketch that out in detail. Onetime GOP rival Ted Cruz, without providing any evidence, has speculated that Trump could be hiding donations to “liberal groups like Planned Parenthood.” Trump’s Foundation, which is financed by contributions from other people, has donated to diverse organizations ranging from the Gay Men’s Health Crisis to the Billy Graham Evangelical Association. Trump has said he’s donated $102 million over the past five years, but a partial list of donations that his campaign provided appeared to correspond to gifts from the foundation — not necessarily from Trump’s own pocket. The Trump Organization’s website used to refer to Trump as an “ardent philanthropist.” Trump’s tax returns could help show whether the description fits.

___

GOLF GAMES

Tax returns could reveal whether Trump has gotten a whopper of a tax break by promising not to build luxury houses that he never seemed interested in building to begin with. The land in question is a driving range at the Trump National Golf Course in Los Angeles. Tax attorneys say that by making a formal pledge to a land conservancy that he will never to develop homes there, Trump could be entitled to a sizable tax deduction for the golf easement.

___

TRUMP, THE LIFESTYLE

Trump’s taxes could tell a lot about how much of his high-flying lifestyle is being written off as business expenses. The bills for his giant yacht, for example, were written off as a casino expense, according to former casino manager John O’Donnell. Trump’s returns probably wouldn’t itemize every fuel receipt for his jet or the like, but they would likely include total deductions for different types of expenses such meals, travel and more.

___

TRUMP’S NETWORK

Trump reported in his financial disclosures last year that he has nearly 500 businesses, more than 90 percent of them owned entirely by him. Tax experts say many of those companies may well be “pass-through” entities that would be part of his personal tax return. So Trump’s tax return could tell how much income they made, offering fresh information about the financial health of his organization, according to Robert Kovacev, a lawyer at Steptoe & Johnson and former Justice Department Tax Division official who represents taxpayers in high-profile tax disputes with the IRS.

___

WILD CARDS

Experience with other candidates indicates there’s no telling what else could show up in those returns. President Richard Nixon ended up paying an extra $465,000 after he released his tax returns and they turned out to contain errors and mischaracterizations, says Thorndike. The Clintons’ tax returns offered details about Hillary Clinton’s lucrative trading in cattle futures when she was first lady of Arkansas. Bernie Sanders attracted some attention for deducting nearly $9,000 in business meals last year. GOP 2012 nominee Mitt Romney, in a Facebook post Wednesday urging the release of Trump’s returns, suggested all sorts of possibilities: “While not a likely circumstance, the potential for hidden inappropriate associations with foreign entities, criminal organizations, or other unsavory groups is simply too great a risk to ignore for someone who is seeking to become commander in chief,” he wrote.

As reported by Vos Iz Neias