Britain’s withdrawal from the EU is not likely to cause an actual worldwide crisis, says the Finance Ministry in a report; it may even be to Israel’s benefit by increasing export demand.

According to a report published Sunday by the Ministry of Finance, the financial implications last week’s British referendum calling for their withdrawal from the European Union are not necessarily negative, from an Israeli point of view.

The Finance Ministry estimates that the UK’s exit is likely to increase uncertainty, lower investors’ confidence, and cause a series of shocks to the financial market in Britain and across Europe. The British economy is the fifth largest in the world and the second in Europe, yet it is less than 4 percent of the global GDP (about one sixth of the US GDP).

According to the ministry, a recession in the UK, in light of the damage to its exports, is not likely to bring about a real global crisis, but it may contribute to volatility in capital markets that will accompany the ongoing process of exiting the EU. “The global effects will depend on the extent of the British economy’s crisis and the degree of spillover to EU countries.”

Meanwhile, the Finance Ministry estimated that the impact of volatility in global markets on the Israel capital markets will be similar to that of the 2012 eurozone crisis, following which the Israeli capital market indices declined 6.5 percent.

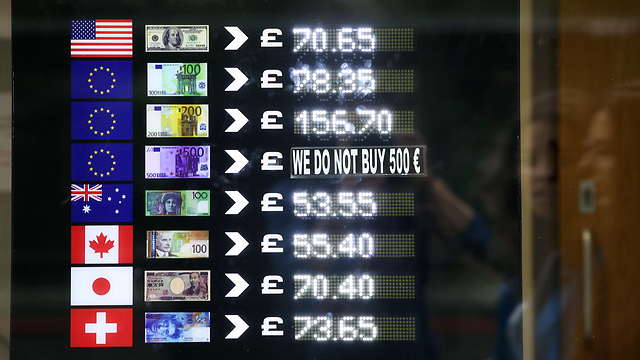

“Realistically, we reiterate that Isareli exports to the UK are less than $5 billion ($4 billion of goods exports and some $800 million of exports of services),” the ministry added. “If we assume that the devaluation in the pound is permanent and Israeli export flexibility to Britain relative to the exchange rate against the pound is 0.2, then the negative impact of Israeli exports will be small, around 0.1 percent.”

If growth in the UK (and to a lesser extent, growth in the EU) suffers, the Finance Ministry believes that it could lead to a certain decline in the demand for Israeli exports. “However, it is possible that the UK’s exit from the EU will improve Israel’s ability to compete in the European market (which is a major destination for Israeli exported goods).”

The ministry explained that, in this scenario, an increase in Israeli exports to Europe is likely in high-productivity goods, such as pharmaceuticals, electronic machinery and equipment, and optical equipment, which they say Israel has a relative advantage on in export and which now constitute a significant share of British exports to Europe.

A potential positive impact on Israeli exports, according to the Finance Ministry, is the possible increase in British demand for Israeli exports, which could substitute importing from Europe in many industries, such as pharmaceuticals. Israeli exports constitute 40 percent of the total British imports in this sector.

According to economic bodies throughout the world, in the event that Britain would be denied direct access to the EU market, the flow of direct foreign investment in the country would decrease. That, together with increased uncertainty, would lead to an overall decline in investment. Meanwhile, the financial sector will be affected by the reduction in activity in the City of London. At the same time, the damage is expected to concentrate on the UK’s neighbors (e.g., Ireland and Belgium), which export a significant share to Britain.

As reported by Ynetnews